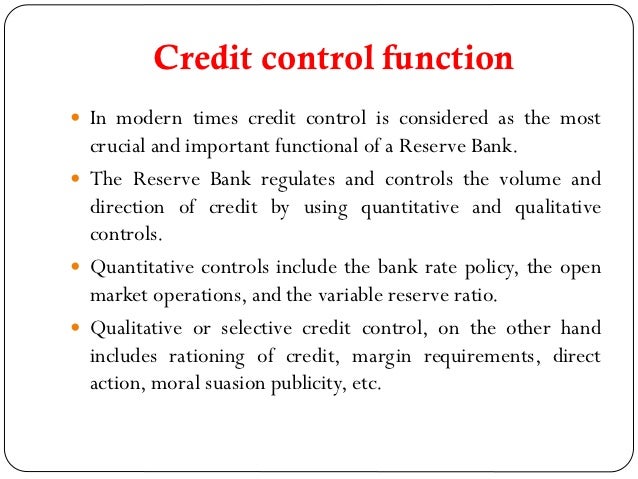

Regulating the credit by taking into consideration of the money supply and inflationary pressure.Containing inflation for sustaining growth momentum.

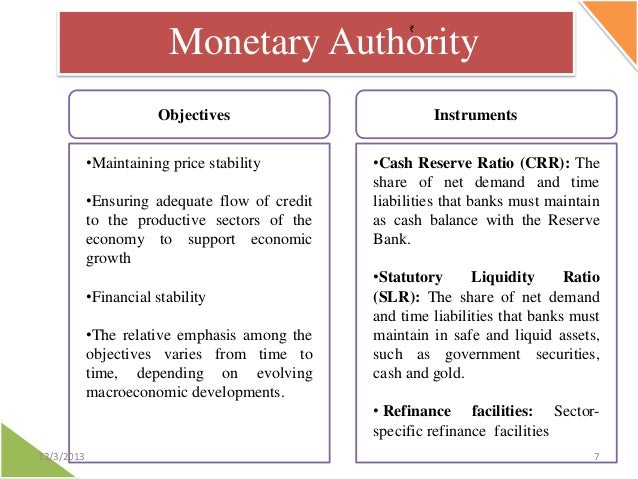

Ensuring macroeconomic and financial stability.The major objectives of the policy are.It also reviews the implementation of the policy forĮvery two months and revises the rates and ratios like Statutory Liquidity Ratio (SLR), Cash Reserve Ratio (CRR), Repo Rate and Reverse Repo RateĪnd also initiates suitable measures for sound economic growth and for containing the inflation. RBI announces the annual monetary and credit policy every year during the last week of April.Reserve Bank of India through its Monetary and Credit Policy in accordance with the economic precedences of the Government. So, control of credit is an importantĭescription about the functioning of RBI is not complete if it is not discussed about the role of Reserve Bank of India in control of credit. It is represented as Government's agent at the World BankĪnd the International Monetary Fund (IMF).Ĭredit plays an important role in supply of money, which in turn impacts the economic stability of the country. It makes paymentsĪnd receives funds on behalf of the Government. The RBI handles the banking requirements of the Government of India by operating and maintaining the Government's deposit accounts. It is one of the important monetary functions of RBI. The RBI has the custody of India's foreign exchange reserves and through these RBI reserves, it acts when there is a depreciation in Rupee value and when there exists crisis in balance of payments position. The powers of RBI under Banking Regulation Act, 1949 include inspecting any bank and its books, ask for its accounts, conduct specialĪudit, ask to initiate insolvency procedure for a defaulting bank, etc. Every commercial bank will have to maintain a part of their reserves in the form liquid cash with the RBI.Ĭommercial banks approach the RBI in times of exigency to survive from financial difficulties and the RBI comes to their rescue and hence RBI guides and directs all the commercial banks and Non-Banking Finance Companies in theĬountry. It is the main non-monetary function of RBI. Is being issued by the Ministry of Finance. The one rupee note contains the signature of Finance Secretary and Signature of RBI Governor except the one rupee currency note. One of the most important functions of Reserve Bank of India is that it has the exclusive right to issue banknotes, which bear the The importance of RBI is huge in India as it does many functions. It can further be extended up to another 2 years after that. The tenure of Governor and deputy Governors is 3 years and If we consider the RBI structure, it is headed by a Governor, who is being assisted by 4 deputy Governors, below whom there will beĮxecutive Directors and Managers at different levels and then the supporting staff. National Rural Employment Generation Scheme.Other specialist banks exist, each with a unique function to play in the financial development of the country.NABARD (National Bank for Agricultural and Rural Development) – People can resort to NABARD for any type of financial support for rural, handicraft, village, and agricultural development.This type of bank can provide loans or other financial help to foreign countries that are exporting or importing goods. Export and Import Bank (EXIM Bank) - EXIM Bank stands for Export and Import Bank.

With the support of this bank, small businesses can get current technology and equipment.

Role and functions of rbi download#

Download for Bank Exam Preparation A Complete Set of Puzzle & Seating Arrangement- CLICK HERE Local Area Banks (LAB)

0 kommentar(er)

0 kommentar(er)